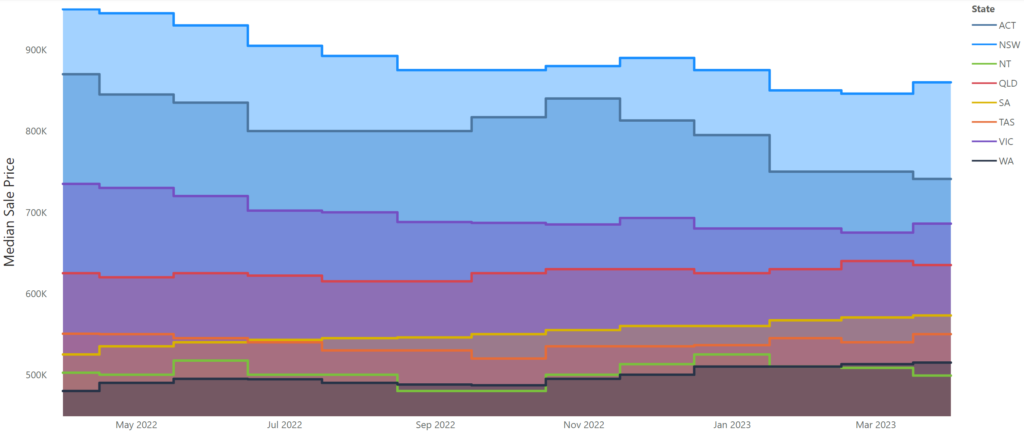

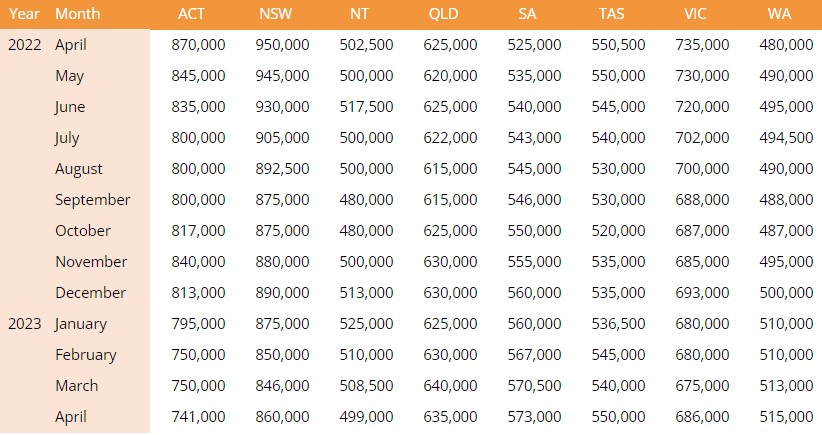

After a couple of flat months, several of the largest markets are now showing median sales price increases suggesting they may have bottomed out and are recovering. The Reserve bank has steadily increased the cash rate by 0.25 % points from October 2022 through March 2023 which is clearly impacting sales activity. However the RBA has announced no increase on 4th April which potentially encouraged some buyers back into the market.

New South Wales after steadily declining since November 2022 and spending two consecutive months with median sales below $850K finally bounced back with $860K in April. For the past quarter Victoria has reported $680K but showed a lift, albeit small, to $686K in April. Conversely, Queensland, South Australia, Western Australia and Tasmania have all remained steady on a long term growth trajectory.

However while some industry commentary has put the worst behind us, the RBA just increased the cash rate another 0.25 % points in May and has warned that further increases are still on the cards. Hence it remains to be seen in the coming months whether the markets in New South Wales and Victoria are truly gaining ground or we’re witnessing a dead cat bounce.

REIP – Median Sales Prices Year to Date