Both New South Wales and Victoria have traditionally been the auction leaders as a method of sale. In this piece, we review the level of auction activity in Victoria and explore the differences in median sales price compared with private treaty. The information contained here relates exclusively to the REIP membership base and covers the period from Jan 2022 (post the Victoria COVID lockdown periods) to March 2023 incorporating REIP settled and unsettled sales data.

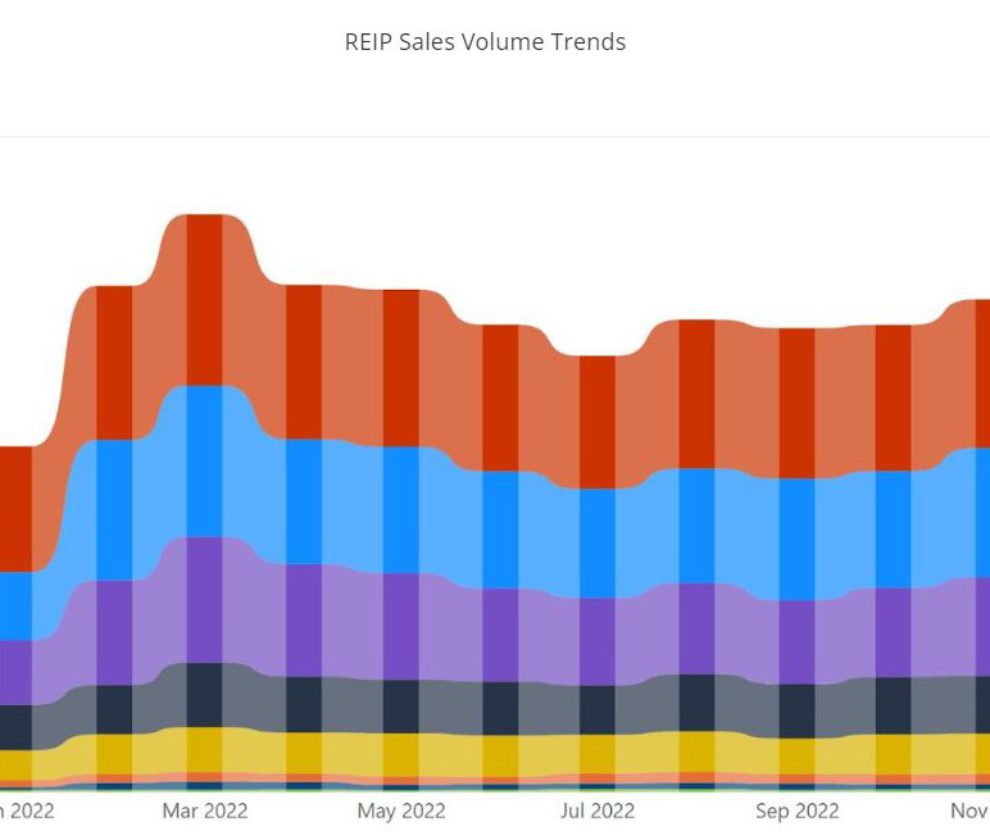

Overall, the sales volumes have settled into a steady state since the lockdowns ceased over a year ago. Q1 2023 was down 20% on the same period last year as per the rest of the industry but the seasonality over the past fifteen months through winter and the Christmas holiday period is as expected.

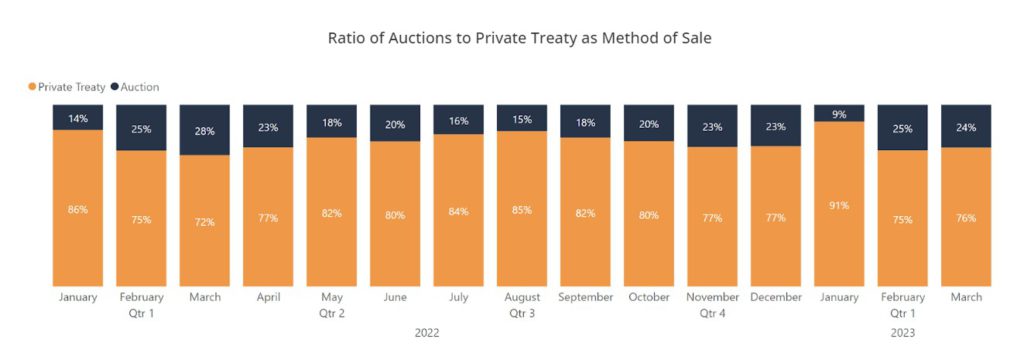

The proportion of sales achieved through auction shows similar seasonality decreasing over winter when the weather is less suited to onsite activities and the end of summer/onset of autumn hosting the highest auction volumes. Overall, the level averages out at 21% of sales by auction over the fifteen-month period, slightly higher than NSW but both comfortably ahead of any other state.

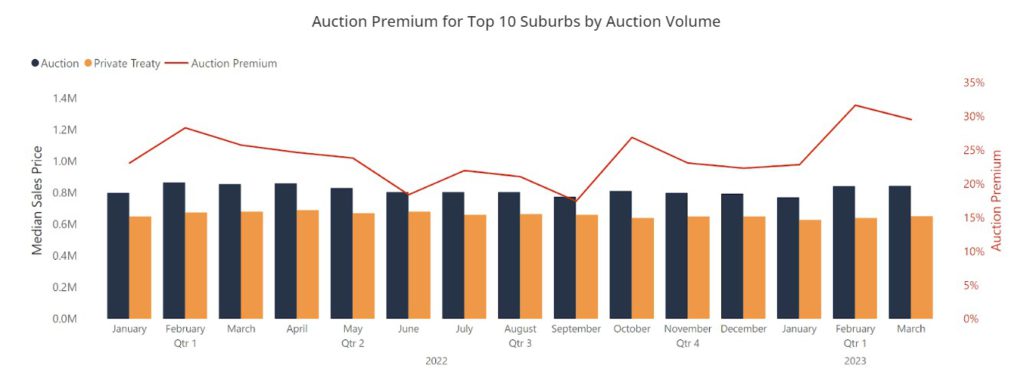

Auctioning is often touted as a means to achieve the best price assuming there is competition amongst buyers. Whether this holds true in every instance in all markets is often debated but nonetheless, the statistics charts below show that amongst REIP agencies in Victoria, median sales prices achieved through auction are overall 15-20% higher than sales in the same period achieved through private treaty. This trend is consistent across both houses and units.

Not every suburb exhibits this trend of course. Taking the top ten suburbs by auction volume we see some suburbs only realised modest auction sales price premiums but in all cases, there was a positive premium overall. Some of the highest premiums were recorded in Bundoora, Mill Park, South Morang and Thomastown which are all neighbouring suburbs positioned northeast of Melbourne. These are all relatively affordable family-friendly suburbs with good amenities, education facilities, and transport links making them sought after by a large home-owning segment fostering keen competition amongst buyers.

Looking ahead, the percentage of auctions over private treaty dropped slightly in March compared to the same time previous year and while it is too soon to make predictions, there is inevitably a wave of homeowners coming off fixed mortgages needing to refinance under much less favourable rates. This may in time fuel an increased portion of auction activity serving mortgagee sales – with some adverse impact on the price premium able to be realised through this sales method.