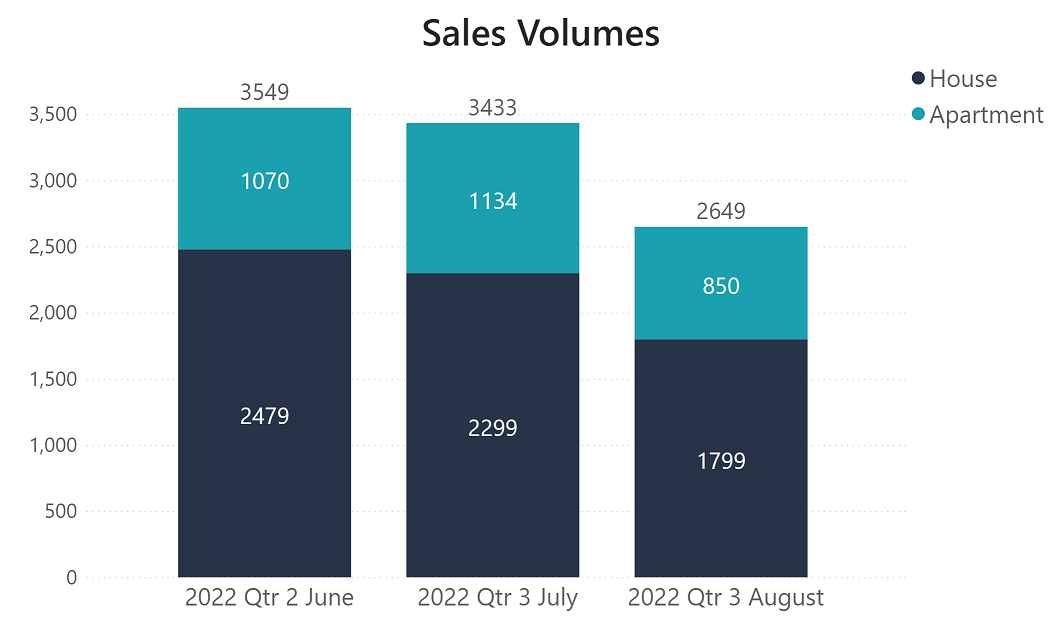

With winter behind us, REIP’s exclusive data allows us to see how the market held up over the traditionally softer period ahead of the official Valuer General statistics. Volumes declined as expected – noting August may yet shore up as month-end sales trickle in. However, there were some distinct trends emerging between main dwelling types in the three states with a significant apartment market; New South Wales, Victoria and Queensland.

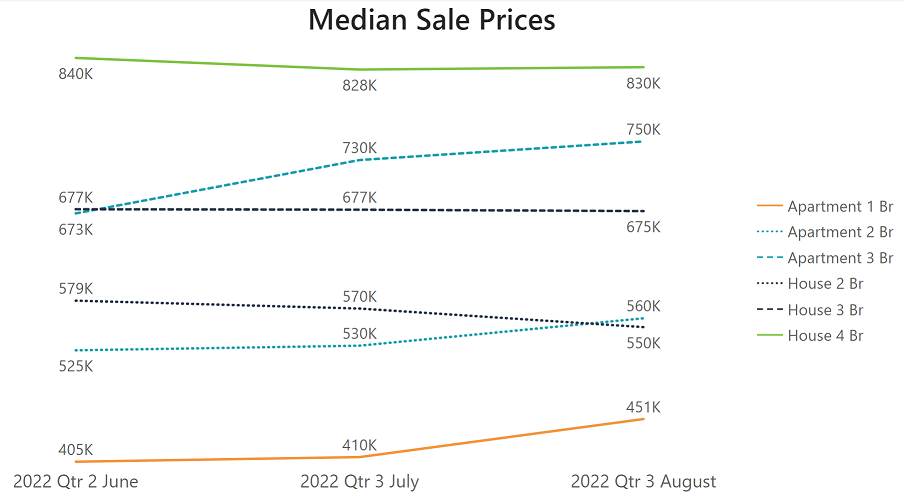

Applying the spotlight to only the suburbs with both house and apartment sales, showed house prices generally softening over the period amongst two and four-bedroom dwellings whilst holding their own in the three-bedroom category. Yet during this period apartment prices in the most popular configurations (1-3 bedrooms) rose steadily to the extent that:

- Median sales price of two-bedroom apartments reached parity with two-bedroom houses.

- Median sales price of three-bedroom apartments grew to exceed that of three-bedroom houses by 75k.

In the smaller two-bedroom categories there is potential crossover as new apartments compete with older housing stock. During the COVID pandemic, there was a feeling that people would gravitate to larger houses in regional areas as work from home tested existing spaces and opened new lifestyle opportunities.

However, the sales evidence suggests that whilst size matters, location remains a strong incentive and is reflected in significant demand for well-located quality apartments. People increasingly spending more time at home are likely attracted to urban environments with nearby parks, cafes and other amenities.