In my last post, I announced REIP’s partnership with AMLHUB, bringing specialised AML compliance support to the real estate industry. Today, I want to share more about what this partnership means for you and how AMLHUB can help your business prepare for AUSTRAC’s updated AML/CTF Reforms Guidance, coming into effect in March 2026.

For real estate professionals, the reforms provide clarity on obligations under the AML/CTF Act, particularly around Risk Assessment (RA) and Customer Due Diligence (CDD). They adopt a practical, risk-based approach, moving compliance beyond “tick-box” exercises to genuinely understanding and managing risk at both the business and customer levels.

Key areas for compliance

These reforms bring Australia closer to international AML standards, and in the real estate sector – where large transactions and complex ownership structures are common – this represents a meaningful shift toward a truly risk-based approach. To ensure compliance, agencies should focus on two key areas:

1. Business-wide risk assessment

Every real estate business must identify and evaluate its exposure to money-laundering and terrorism-financing risks, including:

- Types of services and customers

- Delivery channels and jurisdictions

- Business-wide vulnerabilities

2. Individual customer risk rating

Agencies must also assign a risk rating to every customer. This involves developing a customer risk rating system, identifying risks at onboarding, and monitoring them over time. For example:

- Low risk: Domestic clients, simple ownership structures

- Medium risk: Layered structures or moderate-risk jurisdictions

- High risk: Foreign PEPs, high-risk jurisdictions

Clear documentation is essential for demonstrating compliance during audits.

How AMLHUB can help

The new requirements may seem complex, which is why we encourage you to contact AMLHUB to ensure your agency is ready ahead of the 31 March 2026 AUSTRAC registration deadline.

When you reach out, AMLHUB will:

- Assess your business requirements and determine the level of support you need

- Appoint an AML Compliance Officer

- Develop a comprehensive Risk Assessment and Compliance Program tailored to your business

And AMLHUB is offering REIP members 25% off their standard monthly subscription. Please remember to mention your REIP membership when contacting AMLHUB to access this exclusive offer.

Rather than seeing these reforms as an obligation, treat them as an opportunity to strengthen your compliance capability and align your agency with global best practices.

Until next time,

Stay connected.

![]()

![]()

Sadhana Smiles

CEO, Real Estate Industry Partners

The Federal Government has brought forward the Home Guarantee Scheme to October 2025, ahead of the more targeted Help-to-Buy Scheme. The Home Guarantee Scheme is generous, no income caps, higher price caps, and just a 5% deposit needed, making it attractive to buyers who already have some savings.

The problem? The Help-to-Buy Scheme, which is means-tested and designed to genuinely help those struggling to get into the market, starts later. By prioritising the more generous scheme, competition and prices will rise, making it harder for the buyers who need help the most.

You can read the full article here.

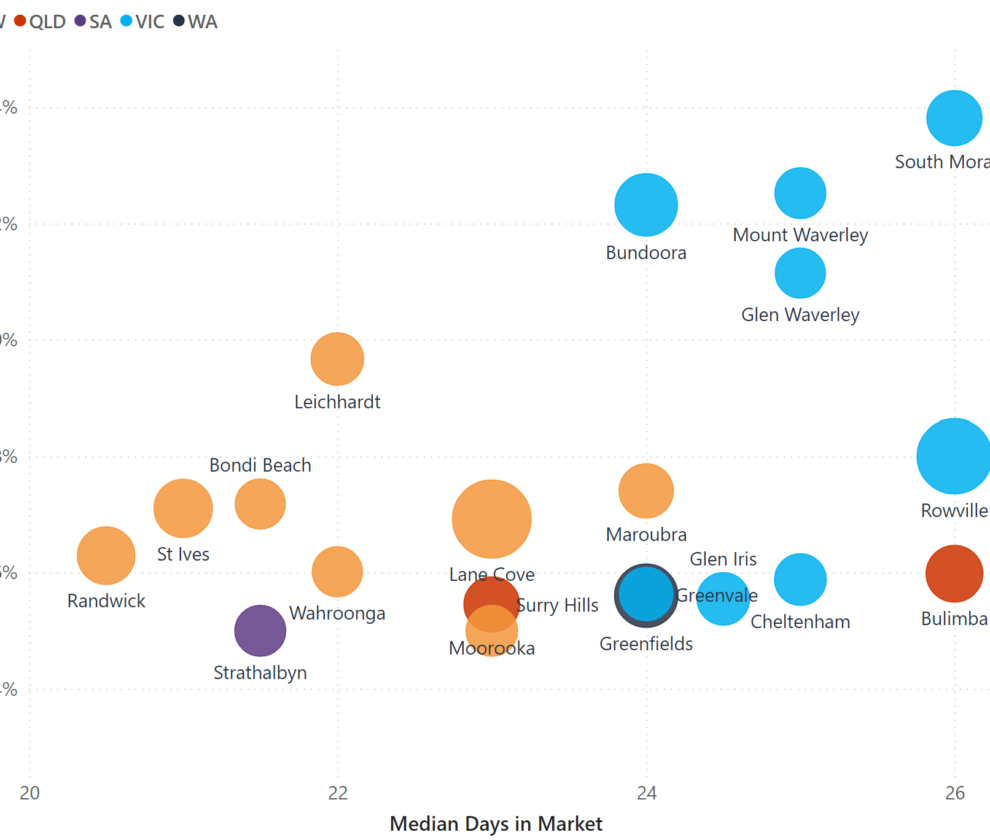

Your industry-backed and owned CMA and market insights tool helping you drive your real estate business with your data

Not an REIP member yet?

Join today for free and access exclusive discounts and offers from our partners.

Keep up to date with the latest industry news.

Subscribe to REIP Inside Real Estate.